capital gains tax proposal washington state

This means long-term capital gains in the United States can face up to a top marginal rate of 371 percent. Start the day smarter Notable deaths in.

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

The political action committee behind an initiative to repeal Washingtons capital gains tax has continued to rake in funds from wealthy donors having now brought in over 211000 with another.

. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax. This includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a. In addition to federal taxes on capital gains most states levy income taxes that apply to capital gains.

Our breaking political news keeps you covered on the latest in US politics including Congress state governors and the White House. They pay taxes on capital gains and. At the state level income taxes on capital gains vary from 0 percent to 133 percent.

Americans pay payroll taxes including the 62 Social Security tax and the 145 Medicare tax. Senators Cynthia Lummis R WY and Kirsten Gillibrand D NY are proposing a tax exemption for up to a certain level of capital gains on cryptocurrencies as part of new forthcoming legislation. Income taxes are just one of many ways a person pays taxes.

States due to state and local capital gains taxes leading to a combined average rate of over 48 percent compared to about 29 percent under current law. Rates would be even higher in many US. A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assets.

Bidens proposal would raise the top federal rate on long-term capital gains and qualified dividends to 396 from 20 for taxpayers.

The Relationship Between Taxation And U S Economic Growth Equitable Growth

The Relationship Between Taxation And U S Economic Growth Equitable Growth

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Controversial Capital Gains Tax Spooks Wealthy Washington Residents As Some Unload Their Stocks Geekwire

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How Do State And Local Individual Income Taxes Work Tax Policy Center

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

How High Are Capital Gains Taxes In Your State Tax Foundation

2022 Capital Gains Tax Rates In Europe Tax Foundation

Millions Still Haven T Gotten Stimulus Checks Including Many Who Need Them Most Propublica Business Tax Tax Return Tax Refund

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Biden Budget Tax Plan Raises Tax Rates To Highest In Developed World

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

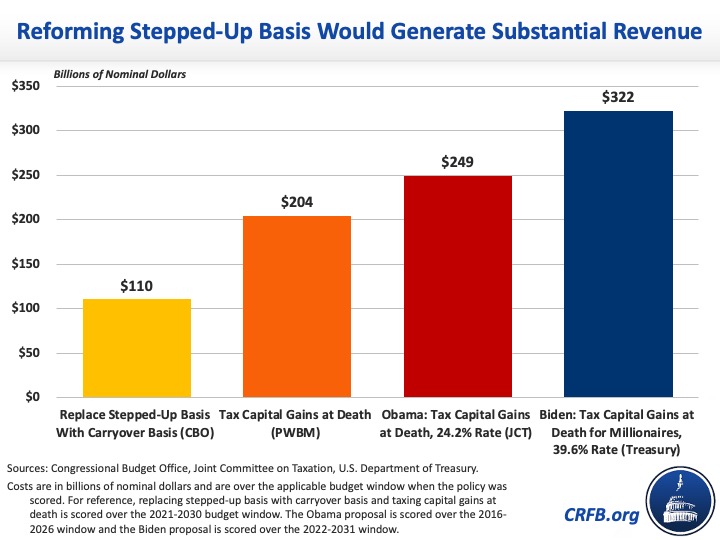

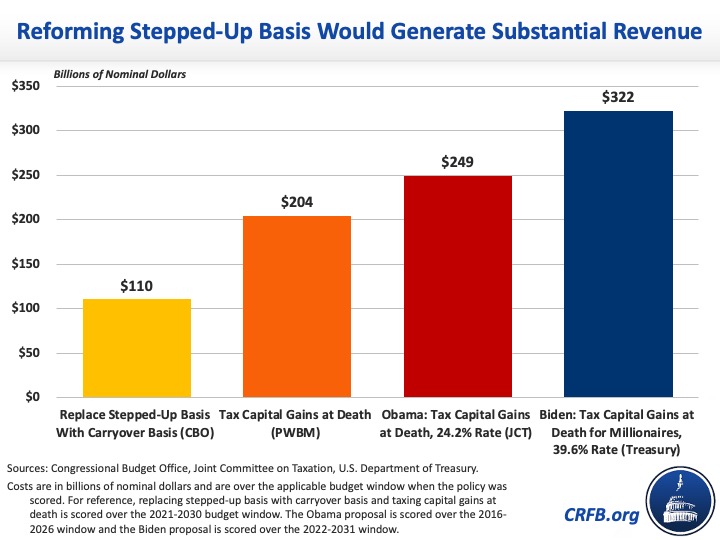

Closing The Stepped Up Basis Loophole Committee For A Responsible Federal Budget

A2z Valuers Offers Valuation Services In Field Of Capital Gain Valuation Every Body Can Get His Profit With That Https Goo Gl Job Bell The Cat Capital Gain

Amy Frogge On Twitter In 2022 Charter School Proposal Bring It On